Employees must affirm they received health coverage throughout the year. Many employees are confused over how to report that they received health coverage when filing their income tax returns this tax season, the first in which they’re required to affirm that they had

Affordable Care Act (ACA)-compliant coverage throughout the year or risk penalties under the individual coverage mandate. Much of this confusion involves Form 1095-B (Health Coverage) and Form 1095-C (Employer-Provided Health Insurance Offer and Coverage).

“There are two different 1095 forms that an employee or former employee might get, depending on how coverage was provided,” explained Mike Chittenden, a counsel at Miller & Chevalier in Washington, D.C. “If it’s fully insured coverage from a large employer”—with 50 or more full-time employees or equivalents—“then they’ll receive a Form 1095-C from their employer and a Form 1095-B from the insurance company. If it’s self-insured coverage from an employer, they’ll just receive a 1095-C that combines the information that would otherwise appear on both forms.” For small businesses with fewer than 50 full-time employers or equivalents that provide employees with an ACA-compliant group plan, the rules are a bit different. If fully insured (as most small companies are), the insurance company that provides coverage is required to send enrollees a copy of Form 1095-B. If a small company is self-insured and provides coverage, it must provide employees with Form 1095-B. But small business that offer insurance are not required to send Form 1095-Cs to employees or to the IRS. Originally, these forms were intended to be given to employees or former employees by Feb. 1 (as Jan. 31 fell on a Sunday this year), along with Form W-2.

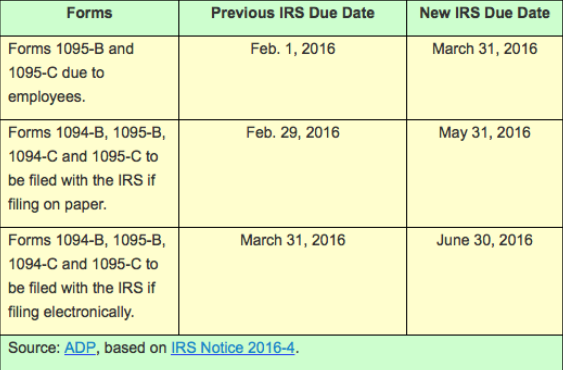

Filers would then use them when completing Line 61 of their individual tax returns, showing that they had qualifying health coverage from their employer—referred to as minimum essential coverage—during the year. The form could be shared with tax preparers and retained with other tax documents. But as many employers seemed unlikely to meet this deadline, the IRS issued Notice 2016-4 at the end of 2015, extending the due date for providing employees with Forms 1095-B and 1095-C until March 31, and extended other ACA reporting deadlines as well:

Tax Filing Conundrum

The problem is that many employees had been told that they would need these forms to prepare their 2015 income taxes. Many even believed, incorrectly, that Form 1095s were to be filed with their tax returns, along with their Form W-2s.

To mitigate these concerns, in January the IRS updated its webpage with Questions and Answers about Health Care Information Forms for Individuals. In Q&A number 3, the IRS answers the question, “Must I wait to file until I receive these forms?” as follows: If you are expecting to receive a Form 1095-A [for those enrolled in a nongroup plan through the ACA’s Health Insurance Marketplace], you should wait to file your 2015 income tax return until you receive that form. However, it is not necessary to wait for Forms 1095-B or 1095-C in order to file.

Some taxpayers may not receive a Form 1095-B or Form 1095-C by the time they are ready to file their 2015 tax return. While the information on these forms may assist in preparing a return, they are not required. Individual taxpayers will generally not be affected by this extension and should file their returns as they normally would.

Like last year, taxpayers can prepare and file their returns using other information about their health insurance. You should not attach any of these forms to your tax return. But employees don’t typically read the latest IRS updates posted online. Employers, therefore, should inform workers to expect these forms by March 31, and assure them they may go ahead and file their taxes—and collect any refunds that may be coming their way—without waiting until the form is in their hands.

Filing Without Form 1095

“While the form is helpful, obviously, in that it gives you all the information you need in one place, most employees won’t need the form to complete their taxes,” Chittenden explained. “For example, if an employee worked for the same company and had coverage all year, then they can go ahead and complete their taxes and check the box that indicates coverage all year. Similarly, if they changed jobs but had coverage under their old and their new employer without a gap, they also can check the box saying ‘yes.’ You don’t have to attach a copy of the form to your return, whether you’re filing paper returns or filing electronically. So you don’t actually need Form 1095-B or Form 1095-C to complete your tax return.”

Given the deadline extension for providing these forms, “employees should be reassured that they don’t need them to complete their taxes, and employers should be telling them that,” Chittenden said.

Ask HR

If employees think they might have had a gap in health coverage but aren’t sure, they still don’t necessarily need the form. “They could look at their pay stubs to see if they include information about coverage—for example, if there are deductions in each month for coverage, then it’s a pretty safe bet that they probably had coverage in each month,” said Chittenden. “They can also go to the employer and ask HR, which can give them the answer about whether or not they had coverage.”

ACA reporting has been a challenge for many employers, and “they’re doing their best to get these forms out as quickly as they can,” said Chittenden. Due to the rush, “employees may subsequently receive corrected forms, if the employer determines later that they were inaccurate, so that’s something they should be aware may be coming. And employers should be aware that they have an obligation to correct incorrect forms.”